40+ are points on a mortgage tax deductible

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Mortgage Interest Tax Deduction What You Need To Know

Web Up to 25 cash back So you might have to pay four points to reduce your rate by a full percent.

. Web Points you pay on a mortgage for a second home can only be deducted over the loans life not in the year you pay them however. Web Most homeowners can deduct all of their mortgage interest. Usually your lender will send you Form 1098 showing how much you paid in mortgage points and mortgage interest during.

Web For example if your mortgage points totaled 5000 and you took out a 15-year fixed youd be able to deduct roughly 333 annually 5000180 months 2778. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

Web Generally your home mortgage interest is tax deductible up to 750000. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

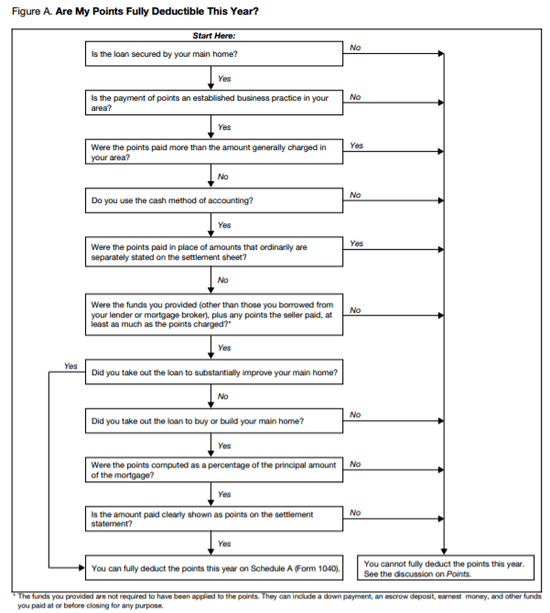

Web You may not be able to deduct mortgage insurance payments if your income exceeds 54500 for individual filers or 109000 for married couples. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Web Is mortgage insurance tax-deductible.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Homeowners who bought houses before December 16. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. One mortgage point costs 1 of. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Say you buy one point on a mortgage loan of 300000 which costs. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web The IRS considers these discount points to be prepaid interest which generally makes them tax deductible in the year you pay them if you meet these.

Web Up to 96 cash back What are mortgage points. Theyre equal to mortgage interest paid up front when you receive your mortgage. For most taxpayers this means your entire mortgage interest is able to be deducted.

Web Yes you can deduct points for your main home if all of the following conditions apply. Web Mortgage points are prepaid interest on your home loan in order to get a reduced interest rate. The mortgage is used to buy build or improve the home and the.

One point equals 1 of the mortgage loan amount. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Here are the specifics. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

That reduced rate can mean a good amount of savings on a. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

If the amount you borrow to buy your home exceeds 750000 million.

Cmhc Mortgage Rules 2023 Wowa Ca

Mortgage Interest Deduction How It Calculate Tax Savings

Tax Deductions For First Year Home Owners Hgtv

Alfonso Peccatiello On Linkedin Markets Economy Centralbanks Earnings Money 57 Comments

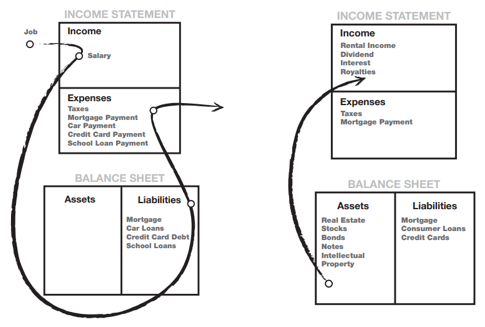

A Complete Rich Dad Poor Dad Summary With Chapter Reviews

Tax Shield Formula How To Calculate Tax Shield With Example

Top Tax Benefits Of Home Ownership

Mortgage Interest Tax Deduction What You Need To Know

Tax Tip Deduct Your Mortgage Points Thestreet

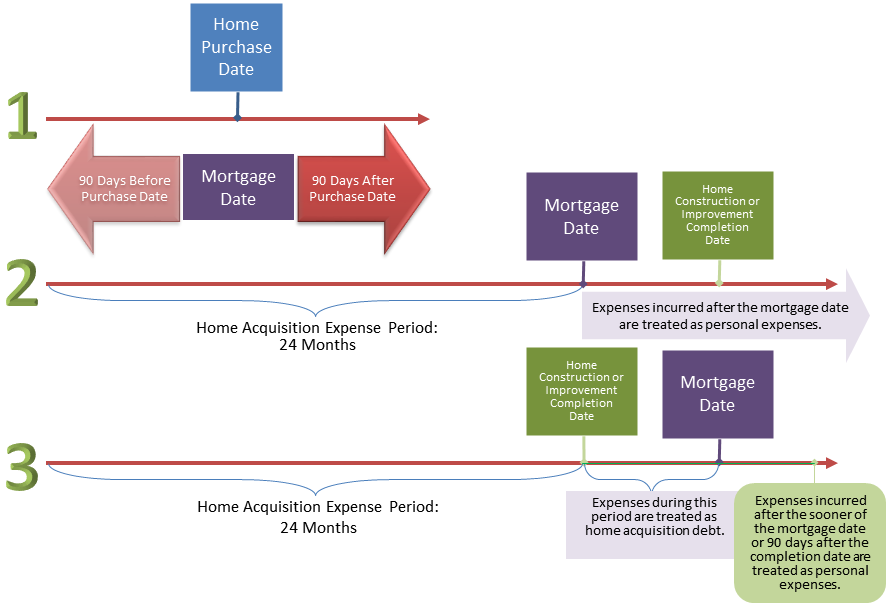

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Small Business Tax Deduction Tips

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How To Deduct Points From A Refinanced Mortgage Or Loan For A Second Home Hgtv

Texas Home Buying What Are Mortgage Points And Should You Buy Them

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street